The October Price Trap: Why You Should Ignore the Listing Price Right Now

- Jeffrey Simmons

- Dec 8, 2025

- 3 min read

Updated: Dec 10, 2025

By Pioneer Data Analytics

🎬 The Bottom Line

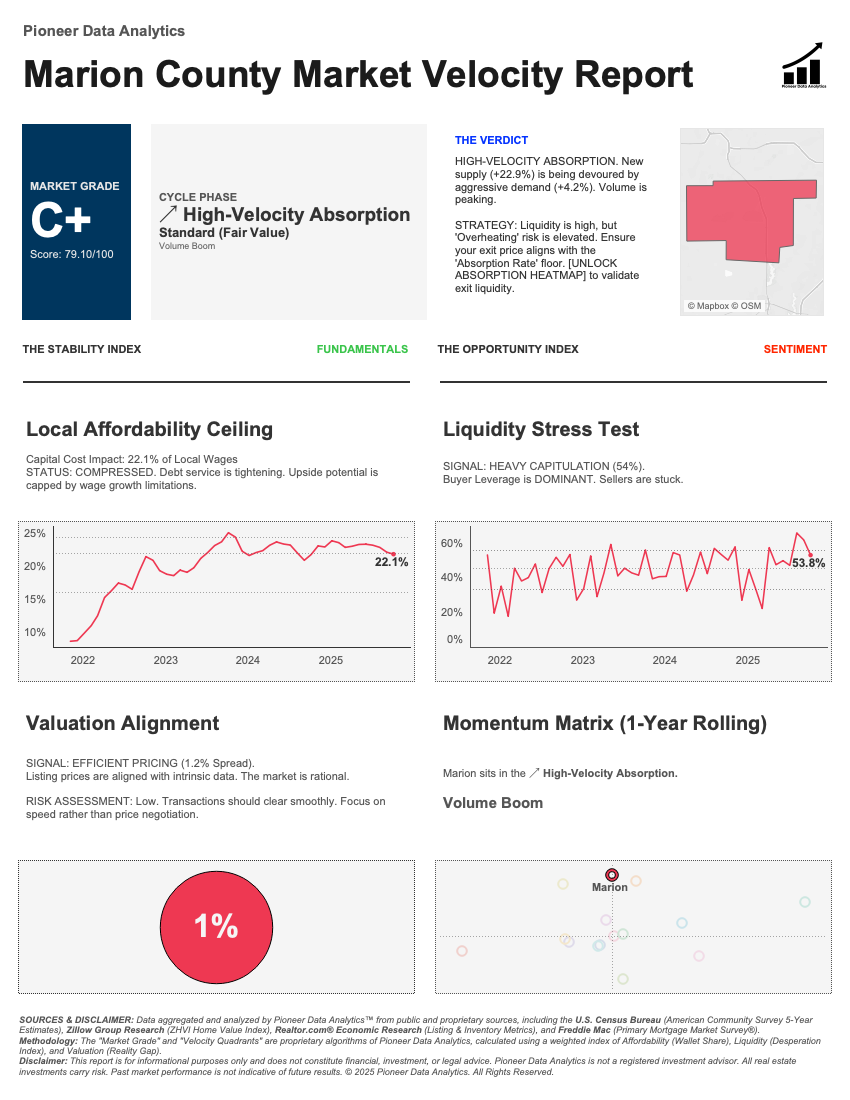

If you're buying or selling real estate in Central Ohio right now, it's a tough situation. Our October 2025 Market Velocity report on fifteen counties shows a major issue called "Heavy Capitulation."

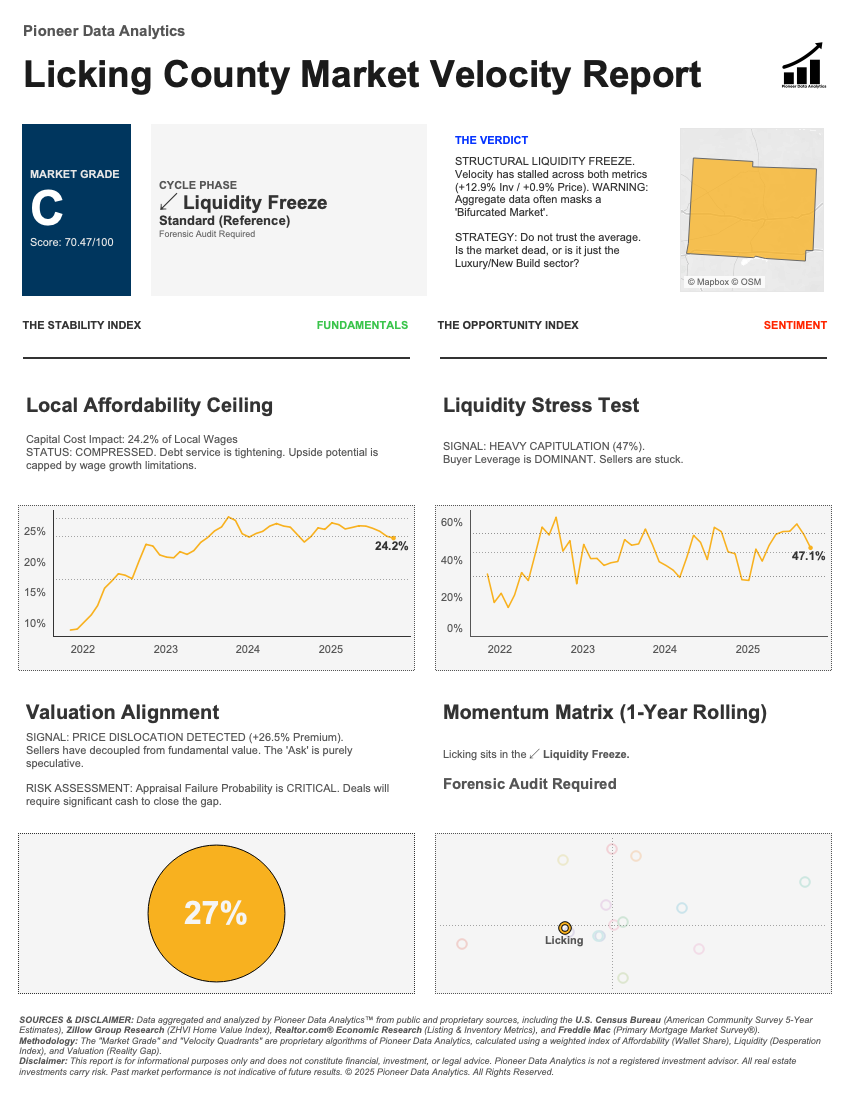

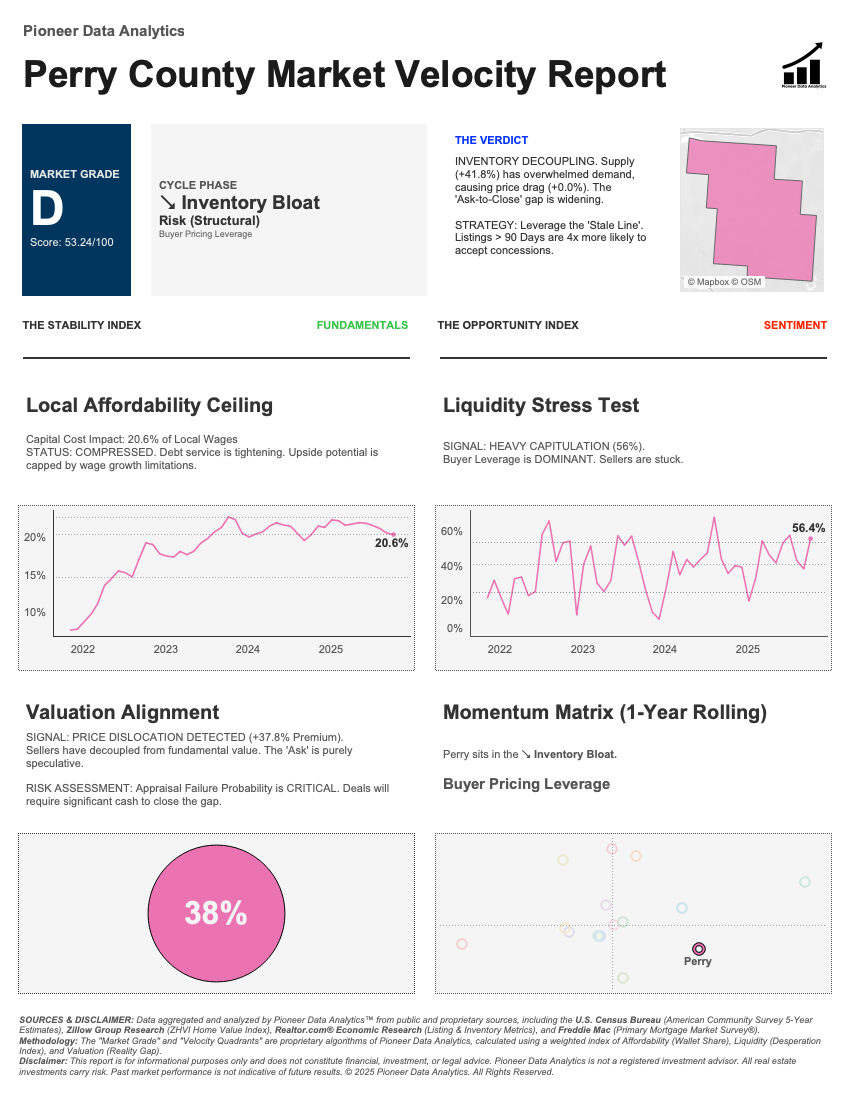

While many people are focusing on interest rates, our findings point to a bigger problem. In the region—from high demand in Marion to excess homes for sale in Hocking—buyers have the advantage. On the other hand, sellers are stuck. The market is stressed, it's hard to afford homes, and the prices being asked are often unrealistic.

📊 Visuals & Trends

We analyzed fifteen regional markets and found they don't behave as one. They have fractured into four distinct cycles, each requiring a different playbook:

⚡️ High-Velocity Absorption (The Boom): In counties like Marion and Delaware, demand is eating up supply. But be warned: except for Marion, premiums are aggressive.

❄️ Liquidity Freeze (The Stall): In Union and Licking, the market has stopped moving. Union County is showing a staggering +93.4% price premium dislocation. Nothing is moving because the prices are theoretical, not actual.

🤏 Inventory Bloat (The Drag): In Hocking and Perry, supply has overwhelmed demand. Listings are stale, and the "time to close" is stretching out.

📦 Supply Squeeze (The Trap): In Knox and Pickaway, there is nothing to buy. This creates "Highest & Best" bidding wars that trap emotional buyers into overpaying.

🧠 Why It Matters

Here is the "So What?" that your standard realtor won't tell you: The "Ask" is purely speculative.

Our analysis flags 14 out of 15 counties for "Price Dislocation." This means sellers are pricing homes based on yesterday's headlines, not today's fundamentals.

⚠️ The Risk: Appraisal Failure. If you agree to these inflated prices, the bank’s appraisal likely won't match. If you don't have significant cash to cover that gap, the deal dies.

😰 The Stress: We are seeing a "Liquidity Stress Test" ranging from 42% to 68%. This measures how desperate the market is for liquidity. When the number is this low, Cash is King.

📋 What To Do Next

Stop guessing. Your strategy must match the specific cycle of the county you are targeting.

In "Bloat" Markets (Hocking/Perry): aggressively leverage the "Stale Line." Properties sitting for 90+ days are statistically 4x more likely to accept concessions. Lowball them.

In "Freeze" Markets (Union/Licking): Ignore the average. The market is bifurcated. Look for the desperation in the mid-tier sector, but avoid the luxury premiums.

In "Squeeze" Markets (Knox): Do not fight on the MLS. Pivot your acquisition efforts to "Shadow Inventory" (off-market deals) to bypass the bidding wars.

🛑 Flying Blind.

📝 Understanding Real Estate Success

Success in real estate is about making smart choices—like using borrowed money wisely to increase your profits. It's important to know how to price properties correctly. Sometimes sellers set a price that's too high, known as a "Speculative Ask." If you don't look into this carefully, you might end up paying too much and losing money.

📚 Doing Your Homework

To avoid overpaying, it’s essential to do your homework. This means looking at the local market, understanding trends in your area, and keeping an eye on things like interest rates and job availability. Getting advice from real estate experts can be really helpful; they can guide you through the tricky parts and help you make choices based on solid information.

🗣️ Negotiation Tactics

Having good negotiation skills can help you deal with those inflated prices. You want to make sure you're paying a fair price that reflects what the property is really worth.

🏆 Staying Ahead in Real Estate

Being proactive and having informed strategies are key to thriving in the sometimes unpredictable real estate market.

Comments